heise-Angebot: IT-Jobtag am 10. November bringt Bewerber und Arbeitgeber zusammen

Im Gebäude der Heise Medien Gruppe in Hannover werden wieder Arbeitgeber aus der ITK-Branche ihre Stellenangebote präsentieren.

Quelle: Heise Tech News

Im Gebäude der Heise Medien Gruppe in Hannover werden wieder Arbeitgeber aus der ITK-Branche ihre Stellenangebote präsentieren.

Quelle: Heise Tech News

Microsoft stellt einen All-in-One PC vor, Apple nicht. Was nicht weiter tragisch ist, denn wir erobern in Civilization 6 die Welt. Sieben Tage und viele Meldungen im Überblick. (Golem-Wochenrückblick, Botnet)

Quelle: Golem

In der Nacht auf Sonntag werden wieder die Uhren umgestellt. Eigentlich sollte das Ritual inzwischen ganz problemlos über die Bühne gehen. Dem ist aber nicht so; deswegen wollen wir von unseren Lesern wissen: Was ist schon alles schiefgelaufen?

Quelle: Heise Tech News

Milliarden Online-Accounts sind in Hackerkreisen und im Netz im Umlauf. Über die Folgen davon sprechen wir in c't uplink. Außerdem: Microsoft und Apple stellen neue Hardware vor und in Ubuntu 16.10 lässt sich jetzt eine neue Bedienoberfläche ausprobieren.

Quelle: Heise Tech News

Tesla

UNIVERSAL CITY, Calif. — A rare cloudy, gray day in Los Angeles cleared up in the late afternoon before Elon Musk took to a stage at Universal Studios to unveil Tesla’s latest product — a solar roof that he envisions will one day sit atop every home.

“The houses you see around you are all solar houses. Did you notice?” Musk said, referring to a cul de sac of houses outfitted with glass tile solar roofs and Tesla’s new $5,500 Powerwall 2 home battery, which packs enough juice to power the lights, sockets, and a refrigerator for a four-bedroom home for a full day.

“The goal is to have solar roofs that look better” with an “installed cost that is less than the cost of a normal roof plus the cost of electricity,” the Tesla Motors CEO said.

The event, which drew more than 1,000 people, came 3 weeks before a Nov. 17 vote where Tesla shareholders will decide whether the two companies should formally merge. Tesla made an offer to acquire SolarCity in June. He also happens to be chairman of SolarCity, the solar energy company led by his cousin. Since announcing the merger, Musk has described the deal as a “no-brainer.” Tesla’s mission, after all, is to “accelerate the world’s transition to sustainable energy.”

Priya Anand/BuzzFeed News

For Tesla, acquiring SolarCity would help the company move toward an ecosystem play: People who want to buy electric vehicles are more likely to have interest in sustainable energy at home, too. The solar roofs, made of quartz, would have a “quasi-infinite” shelf life, according to Musk. “Really, it’s never going to wear out,” he said.

The companies expect to save $150 million annually due to “synergies” if the merger is approved, according to regulatory filings. Wall Street, however, has expressed concern that Tesla, which which surprised the markets this week by delivering a profit last quarter for the second time, would be taking on too much risk by acquiring the beleaguered solar energy company. (SolarCity has about $3.35 billion in debt, according to Bloomberg.)

Asked about investors’ concern, Musk said Friday, “This is not about balance sheet questions.” He noted earlier that if shareholders were to vote down the merger, producing solar roofs en masse with SolarCity would be “unwieldy,” and “definitely suboptimal.”

Priya Anand/BuzzFeed News

Investors might see things differently. Tesla is facing four lawsuits from shareholders, who allege that the carmaker is breaching fiduciary duty by proposing to purchase the solar energy company. Wall Street has largely viewed the proposed merger as a major risk to Tesla’s business. Barclays analyst Brian Johnson called the solar roof unveiling “in our cynical view, part of their PR strategy to lay the groundwork for a vote” through a series of hyped announcements in recent weeks, culminating with the Universal Studios event.

Still, for Musk and Tesla, the Universal Studios event marked another big moment in a year of rapidfire headlines for his companies. Last week, Musk announced that all future Teslas would include the necessary hardware for self-driving capability. The company expects the software needed to demonstrate an autonomous ride from Los Angeles to New York will be ready by the end of next year. That news came as Tesla continues to face a federal investigation over the role its Autopilot driver assistance technology played in recent crashes. Meanwhile, Musk has also outlined his aerospace company SpaceX’s plans to eventually colonize Mars.

But at Universal Studios on Friday, it was all about the solar roofs, which Musk expects to begin rolling out next summer.

“This is the integrated future. You’ve got an electric car, a Powerwall, and a solar roof. It needs to be beautiful, powerful, and seamlessly integrated,” Musk said. “If all those things are true, why would you go any other direction?”

Quelle: <a href="Elon Musk Wants To Power Every Home With A Solar Roof“>BuzzFeed

The last week of October 2016 is over and you know what that means; another #Docker news #roundup. Highlights include Windows workloads with Image2Docker, part four of the SwarmKit series, and a Docker InfraKit test-drive! As we begin a new week, let’s recap our five top stories:

Windows Workloads with Image2Docker – a community supported and designed project to demonstrate the ease of creating Windows Containers from existing servers. Interested parties are encouraged to fork it, play with it and contribute pull requests back to the community.

SwarmKit &8211; Part 4 &8211; a tutorial series on Docker SwarmKit led by Gabriel Schenker. Part four of the series explains how to create a swarm in the cloud and run a sample application on it.

Docker Volumes &8211; user instructions on how to make sure posts and images stay permanent via Docker volumes, even with an upgrade to a container image, as showcased by Alex Ellis.

InfraKit Test-Drive &8211; a detailed illustration of a sample Docker image created to demonstrate InfraKit’s self-healing operation via Ajeet Raina.

Testing Swarm on Raspberry Pi &8211; a screencast of Docker swarm and how it’s able to recover from failure of an ethernet interface. Author Mathia Renner reinforces swarms ability to recover flawlessly from a reboot and crash.

Weekly Roundup: Top 5 Docker stories for the week 10/23/16Click To Tweet

The post Docker Weekly Roundup | October 23, 2016 appeared first on Docker Blog.

Quelle: https://blog.docker.com/feed/

One of Facebook's most appealing traits to advertisers is its ability to target users based on their interests and demographics. On the flipside, the site also gives advertisers the choice to hide ads from specific groups of users, a tactic called exclusion marketing. And this option can lead to unexpected and even unwanted results. A ProPublica report has found has found that Facebook allows advertisers to exclude certain “ethnic affinities” from their ad audiences.

Targeting specific portions of the population is one of the pillars of the digital advertising industry, but it has legal limits. The federal government&039;s Fair Housing Act of 1968 prohibits ads for housing and employment to exclude anyone based on race, gender, and other identities. On Facebook, advertisers may have a way to skirt this rule.

ProPublica was able to create a housing-related ad that excluded anyone with an African-American, Asian-American, or Hispanic “affinity.” Rather than limiting your audience to the groups you select, Facebook&039;s targeting options explicitly allow you to exclude specific groups while creating an ad. Facebook approved ProPublica&039;s ad within 15 minutes.

A Facebook spokesperson told BuzzFeed News that ProPublica&039;s ad is for an event, not a housing advertisement, and that the screenshot the investigative journalism nonprofit included in its article was not the ad that was eventually posted. (It appears ProPublica&039;s screenshot is of the ad on the backend of the site, before it posted publicly.) The spokesperson said this is the ad in its final form:

Facebook did not specify whether the ad excludes certain “ethnic affinities,” as ProPublica says it does.

The distinction Facebook makes between an ad for housing and one for an event about housing — and whether each allows for exclusion — is murky.

The company said in a prepared statement, “We believe that multicultural advertising should be a tool for empowerment…Marketers use [exclusion targeting] to assess whether ads resonate more with certain audiences vs. others.”

Facebook reiterated in the statement that its advertising policies prohibit discriminatory ads. Users can also modify their ad preferences to not include “ethnic affinity” advertising. According to ProPublica, a Facebook said that “ethnic affinity” is not the same thing as race, though he did not quite define what it actually is.

In regards to that enforcement, the spokesperson said Facebook would take down an ad “if the government agency responsible for enforcing discrimination laws tells us that the ad reflects illegal discrimination.” But the company doesn&039;t seem to have a way to screen these ads beyond relying on reports from government agencies.

Facebook also pointed to advertisers&039; targeting practices as evidence of the necessity of the “ethnic affinity” categorization: “All major brands have strategies to speak to different audiences with culturally relevant creative.” The company cited “hair products for African-Americans, ads for Spanish beer” as examples of products that would take advantage of “ethnic affinity” targeting.

Facebook also does not require users to specify their race when entering their personal information, so it bases the “ethnic affinity” categorizations on users&039; “declared interests or the Pages that they like,” Facebook wrote in a prepared statement.

Quelle: <a href="Facebook Lets Advertisers Hide Ads From People Based On "Ethnic Affinities"“>BuzzFeed

C Flanigan / Getty Images

Former employees of one of Silicon Valley’s most valuable startups are struggling to cash out of the stock options that formed a major part of their pay packages.

As it grew into a $20 billion company, Palantir Technologies convinced top-tier engineers to accept salaries considered meager by Silicon Valley standards, pairing the relatively low wages with generous stock option grants. But some former employees who accepted this bargain, banking on a future windfall, are now complaining that the market for their stock has gone “completely dead.”

The complaints add to pressure on Palantir CEO Alex Karp, who has long contended that the company would avoid the public markets. This week, Karp acknowledged publicly that he was “positioning” Palantir for an initial public offering, as part of efforts to reward cash-starved employees.

This reversal didn’t come out of the blue. A chorus of complaints has arisen in a private Facebook group for Palantir alumni, with many former employees expressing concern and regret over their inability to sell their shares. In September and October, two former employees promoted possible opportunities to join together to sell a block of shares, including an unsuccessful attempt to organize a sale in China.

Numerous other former employees shared personal stories: Some said they needed the cash to buy a house or pay down debt, while another said they took out a loan to fund the process of turning the options into shares. One said it was “infuriating” trying to sell their shares in a “crap” market.

Compared with last year, when the stock was highly sought after, demand among big investors for Palantir shares has recently gone cold, two brokers who specialize in startup shares told BuzzFeed News.

This chill reveals more about the fickle and sometimes inscrutable nature of markets for startup stock than it does about the business health of Palantir, which makes money by analyzing data for government and corporate clients. But it has stirred frustration among current and former employees.

A complaint about Palantir’s below-market compensation was the most upvoted question in an internal question-and-answer session in the first part of this year, with 259 votes from employees, an internal document reviewed by BuzzFeed News shows. “Our cash compensation + bonuses are below the market for tech and our equity growth has slown significantly,” the question, posed anonymously by an employee, said. “The total comp is not competitive; even more so due to the illiquidity.” The questioner continued, “Are we planning to change our compensation model?”

Palantir did move to address such concerns in April, announcing it would raise salaries for many employees by 20% and offer to buy back a portion of employee shares.

But on Wednesday, Oct. 26, in another move that seemed aimed at placating employees and investors, Karp gave the strongest indication yet that an IPO could be on the horizon — though it is hardly a certainty. “We’re now positioning the company so we could go public,” he said from the stage of a tech conference hosted by the Wall Street Journal in Laguna Beach, California. “I’m not saying we will go public, but it’s a possibility.”

An IPO would provide a payday to major investors, including Palantir co-founder and chairman Peter Thiel. “Of course I want my investors to be happy,” Karp said, “but the primary people I care about are the wide-eyed people at Palantir who are working day and night.”

A Palantir spokesperson declined to comment.

With a $20 billion valuation, Palantir is the third biggest American tech startup, behind only Uber and Airbnb. It is also by far the oldest of that elite group, meaning its workers have waited a long time for their stock-option payday. Founded in 2004, Palantir is as old as Facebook — which went public in in 2012. In tech years, it is a generation older than Airbnb, founded in 2008, and Uber, which was founded in 2009. The much younger Snapchat, which was founded in 2011, is reportedly laying plans for an IPO early next year that could cause its valuation to leapfrog Palantir’s.

Stock options have long been central to compensation at Palantir. A 2015 template for a Palantir offer letter gave new hires the ability to choose among three different pay packages, with lower cash salaries corresponding to higher amounts of stock options. “It is our hope and belief that these options will ultimately constitute the bulk of your overall compensation,” says this internal Palantir document, which was reviewed by BuzzFeed News.

To illustrate the potential value of the options, the offer letter template invites new hires to imagine a scenario in which Palantir’s valuation were to grow to $50 billion, or $100 billion — or even $200 billion. “Although the values in the table below are hypothetical and inherently uncertain, we want to emphasize our belief in Palantir’s potential to become a $100 billion company,” the letter says.

While it waits for this dream to materialize, the company has sought to ease financial angst among its employees. It held a “liquidity event” this year that gave current and former employees an opportunity to sell a fraction of their shares. But Palantir also indicated it wanted to curb share sales done outside of its official channels, warning that selling to outsiders could make staff ineligible for future liquidity events.

That outside market hasn’t exactly been humming with deal activity anyway. Trading in private company shares is opaque and fragmented, and data is hard to come by. But the two brokers who spoke with BuzzFeed News said Palantir’s prolific fundraising — the company has raised more than $2.5 billion in capital, according to data provider PitchBook — may have dampened investor appetite. A number of big investors who would want a piece of Palantir already have one, they said.

In May, BuzzFeed News revealed some of the setbacks Palantir has experienced as it seeks to expand beyond its roots as a government contractor and woo major corporations. The article, based on internal documents and insider interviews, reported that Palantir had lost some blue-chip corporate clients, was struggling to stem staff departures, and had recorded revenue that was a fraction of its customer bookings.

At the conference Wednesday, Karp was asked about those customer losses, which included Coca-Cola, American Express, and Nasdaq. “We date heavily before we marry,” he answered.

Even before the article was published, members of the private Facebook group for Palantir alumni voiced concern about selling their shares in the so-called secondary market. BuzzFeed News is withholding the names of former employees to protect their privacy.

“Any 2nd market shares going on right now? My broker disappeared,” one former employee posted in April.

“There are still periodic deals happening,” another replied. “One that I know of right now, but it’s full already.”

“Yeah, the demand has evaporated,” another said.

More recently, however, some of the posts took on an urgent tone, as sales appeared to grow scarcer. Options are contracts to buy shares at a certain price; to use them, the owner must pay this price in addition to applicable taxes — which can amount to a large bill. What’s more, options expire at a certain point if they’re not used, adding time pressure to the equation.

In the public market, owners of options can easily sell a portion of their holdings to cover the tax bill and the exercise price. But this strategy is much trickier in the private market, and there was some debate in the Facebook group over whether Palantir would even allow it.

In September, one former employee asked the group whether anyone was “coming up on their 3-year expiration,” soliciting advice on “approaches people are taking given the less-than-stellar private market.”

Among the replies, one former employee reported taking out “a personal loan to meet my exercise deadline.”

Another wrote: “I’m in the same boat: 3 years coming up in April, market is crap, and I probably don’t have the resources available for a loan. The fact that it’s so difficult to sell is infuriating and I’m wishing that I’d taken the ‘high’ salary option (which TBH wasn’t that high to begin with).”

“On the same boat,” wrote another. “Hoping to buy a house next year and really couldn’t wrap my head around throwing so much money in addition to the stress and work needed to process.”

The former employee who started that thread apparently didn’t receive much solace. In response to a later post, which asked whether there were “any secondary market sales brewing,” this former employee wrote, “Sorry to be the bearer of bad news, but the market is completely dead at the moment.”

This person then quoted an unidentified broker as saying, “There is absolutely nothing moving in Palantir. People who have bought through us are trying to sell now. I don’t see it changing without the company changing their tone on an IPO.”

Others in the thread shared snippets of information they said they had heard from brokers. According to one, a broker “told me that there are a few ‘price insensitive’ sellers satisfying what little demand exists.”

Another former employee wrote: “I’m interested in joining any sales going down too, I’ve got a year to pay off a hefty debt with the proceeds.” The person added a neutral face emoji.

With buyers scarce, one former employee tried looking across the Pacific.

“I spoke to someone that brokers sales in China, they said they might be willing to get something together if there’s enough of us,” they wrote above a link to a Google Doc that asked others to report information about their holdings.

One of the repliers questioned whether this process would actually turn into a sale — potential investors might just be “fishing for information on prices” — and another cautioned the original poster against “acting as an agent for a group of sellers.” (The poster said the query was “just intended as an interest check.”)

In the end, none of that mattered. “Not likely to go anywhere in the next couple of months,” the former employee who posted the opportunity wrote later. “Sorry if I got anyone’s hopes up.”

Early this month, another member of the group posted about an opportunity to sell options through EquityZen, a startup that arranges small transactions of private company shares. This former employee advised others to contact the EquityZen CEO, providing the CEO’s email address. But less than 12 hours later, another former employee replied to say that the deal “has been already submitted,” meaning the opportunity had passed.

“Dang,” another member wrote.

Discussions in the group about news related to Palantir often come back to a familiar theme. In September, for example, the Department of Labor accused Palantir of discriminating against Asian job applicants, a claim Palantir later rejected as “flawed and illogical.” In a thread discussing the allegations, one former employee found a financial angle.

“I sure hope this isn’t an expensive lawsuit for them to defend,” this person wrote. “I don’t claim to understand how the legal system works in cases like this, but geeeeez this doesn’t bode well for any of us looking for liquidity at a fair price over anytime soon.”

Quelle: <a href="Ex-Palantir Employees Are Struggling To Sell Their Shares“>BuzzFeed

Posted by Grace Mollison, Solutions Architect

We here at Google Cloud Platform have been busy working on resources to help you manage identity and security on GCP. Here’s what we’ve been up to.

First off, we’ve been listening to customers and have curated a Google Cloud Identity and Access Management FAQ that answers questions such as ‘What does a Cloud IAM policy look like?’ or “To what identities can I grant IAM roles?” The FAQ already lists almost 40 questions, but if you think there’s something missing please let us know.

Google Cloud Resource Manager’s new Organization resource

Several features of Google Cloud Resource Manager are now generally available, including the ability to use the Organization resource. When you use an Organization resource, the projects belong to the business instead of to the employee who created the project. This means that if that employee leaves the company, his or her projects will still belong to the organization. Further, because Organization admins can view and manage all your company’s projects, this eliminates shadow projects and rogue admins.

You can grant roles at the Organization level that apply to all projects under the Organization resource. For example, if you grant the Network Admin role to your networking team at the Organization level, they’ll be able to manage all the networks in all projects in your company, instead of having to grant them the role for individual projects.

Project provisioning fun with the Cloud Resource Manager API

The Google Cloud Resource Manager API now includes a project.create() feature, which allows you to use scripts and applications to automate project provisioning. Maybe you want to plug into a self-service system to allow developers to request new projects, or perhaps you want to integrate the creation of a new project as part of your CI/CD set-up. Using the project.create() API allows you to standardise the configuration of your projects.

Developers should consider creating different templates for different projects. For example, a data analysis project will have a different composition than a compute project. Using different templates simplifies project creation and management by allowing you to simply run the correct script or template to set up the proper project environment. These scripts can also be treated as code amendments to the standard project creation scripts. You can also version control templates, and revert back to them if need be.

The Cloud Resource Manager project.create() API supports the REST interface, RPC interface, client libraries or gcloud library.

Automating project creation with Python

Let’s look at how to use the project.create() API with Python scripts or templates to automate project creation with a user or service account.

A common scenario for automating project creation is within large organizations that have set up an Organization resource.This example focuses on using a service account to automatically create projects.

Create a service account in a designated project under your Organization resource. We recommended a designated project to contain resources that will be used across the projects in your Organization resource. And because service accounts are associated with a project, creating them in a central designated project will help you manage them.

At a minimum the service account needs to have the resourcemanager.projectCreator IAM role. If you need to enable APIs beyond the default, this will require granting the service account the billing user role at the Organization resource level, so that it can attach projects to the organization resource’s billing account. The service account can then enable the required APIs against the project. The billing account must be associated to the organization resource.

Now that you have a service account that you can use to automatically create scripts, go ahead and create a script that follows this flow:

Create a client with the correct scopes. Here’s a code snippet showing how to create a client:

def create_client(http=None):

credentials = oauth2client.GoogleCredentials.get_application_default()

if credentials.create_scoped_required():

credentials = credentials.create_scoped(CRM_SCOPES)

if not http:

http = httplib2.Http()

credentials.authorize(http)

return discovery.build(CRM_SERVICE_NAME, CRM_VERSION, http=http)

Pass your organization ID and a uniquely generated project ID to a function that checks if the project exists by listing projects and looping through them:

Organization_id = str(YOUR-ORG_NUMERIC_ID)

proj_prefix = “your-proj-prefix-” # must be lower case!

proj_id = proj_prefix+”-“+str(random_with_N_digits(6))

#************************

Here’s a snippet showing how to list the projects in your organization:

def List_projects(org_id):

crm = create_client()

project_filter = ‘parent.type:organization parent.id:%s’ % org_id

print(project_filter)

projects = crm.projects().list(filter=project_filter).execute()

#while projects is not None:

print(projects)

Create a project with the generated name if it does not already exist, with this code snippet:

def create_project(proj_id):

crm = create_client()

print “org id in function is :n”

print(organization_id)

new_project = crm.projects().create(

body={

‘project_id': proj_id,

‘name': proj_id,

‘parent': {

‘type': ‘organization’,

‘id': organization_id

}

}).execute()

And finally, programmatically launch the resources and assign IAM policies.

Now that you can use a script to automatically create projects, the next thing to do is to expand on these steps to automate setting of IAM policies and creating resources for your automation pipeline. Google Deployment Manager does that using declarative templates and is a good tool for automatically creating project resources. Stay tuned for a blog post on the topic.

Quelle: Google Cloud Platform

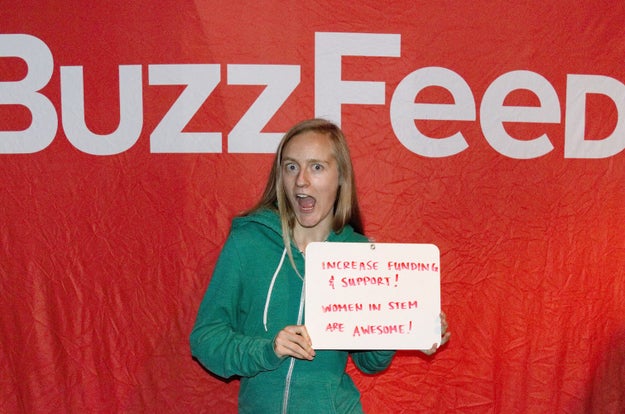

At Grace Hopper, an annual conference that celebrates women in tech, BuzzFeed’s own tech team asked fellow attendees what they thought our next president can do for women in STEM. Here&8217;s what they said.

Fifteen thousand women descended on Houston, TX last week to attend the Grace Hopper conference. The event, which has been taking place for more than 20 years, both celebrates the careers of women working in technology, and serves as a space to discuss the unique challenges faced by woman engineers, developers, coders, hackers, designers, programmers, product managers, and more.

Those challenges are significant. This year, a study using data from Glassdoor found that male computer programmers earn 28.3% more than their female counterparts. According to a report published by the Harvard Business Review, 41% of women end up abandoning careers in tech, compared to only 17% of men.

Five of us: Jane Kelly, Director of Data Products, Phil Wilson, GM of Minneapolis office, Paola Mata, iOS Engineer, Jennifer Wolner, Sr. Project Manager, and Swati Vauthrin, Director of Engineering, went to Grace Hopper to represent BuzzFeed. We had a few goals in mind that included building our BuzzFeed Technology brand, meet individuals in industry to talk about their work, and also talk about the challenges that women in technology often encounter. While we were there, we chatted with women from Google, Microsoft, General Assembly and more about what they think the next president of the United States could do to make tech an easier and better career choice for women.

(The photos below were taken by Jennifer Wohlner, Jane Kelly, Paola Mata, and Swati Vauthrin.)

Katlyn Edwards, a software engineer at Google, loves cats, computers and coffee, and hopes the next U.S. president increases funding for women in STEM!

From left to right, Stefanie Swift and Sophie Cooper are software engineers at CourseHero, Aracely Payan is a student at USC and Malvika Nagpal also works at CourseHero. They want to the next US president to push companies to publish more data around diversity in tech.

From bottom left, Paula Paul of AmWINS Group Inc., Joey Capolongo of Lending Tree, Hannah Lehman of General Assembly, Simone Battiste-Alleyne of the Tax Management Association, and Felicia Jacobs of Microsoft want the next president to help women to earn the same salary as men doing the same job.

Says Paul, “I'm a bad ass coding goddess&033;”

Quelle: <a href="Here&039;s What Some Women In Tech Would Tell The Next President“>BuzzFeed