Before AT&T had even announced plans to buy Time Warner for $85 billion, Donald Trump had denounced the deal, becoming an unlikely bedfellow for Democrats who would soon join the attack.

The earliest reactions to AT&T’s proposal ranged from professional skepticism to unflinching death stares. And while some observers view Washington’s response as nothing more than a bluster of soundbites, others see a new moment for antitrust enforcement, bolstered by the economic populism that has defined the 2016 election.

“There's definitely something new in the air when it comes to antitrust,” Lina Khan, a fellow at New America who researches industry concentration, told BuzzFeed News. “There’s a general awakening that our current antitrust approach has failed at keeping markets open and competitive, and has instead overseen extreme concentrations of economic power.”

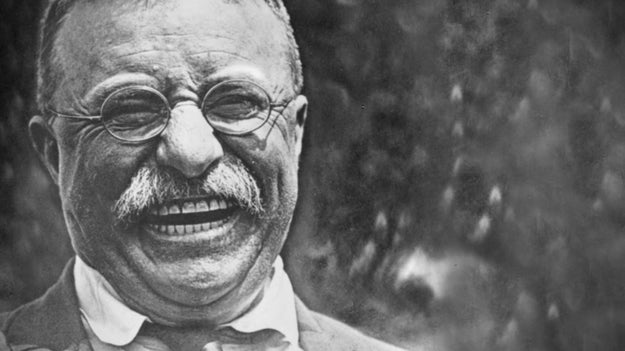

Trump’s senior economic advisor Peter Navarro evoked the trust-busting personae of Theodore Roosevelt in his condemnation of the merger. A President Trump, he said, would “break up the new media conglomerate oligopolies.” Congressional Republicans, including the head of the Senate Judiciary Committee Chuck Grassley assured the public that lawmakers would scrutinize the deal. Meanwhile, Sen. Mike Lee, the chair of the Senate’s Antitrust Subcommittee said the mega-merger “would potentially raise significant antitrust issues.” Joined by the panel’s top Democrat, Sen. Amy Klobuchar, he promised a thorough review and at least one Senate hearing.

“The industry-friendly merger approvals that benefit private interests but undercut consumers — this is the price we pay for a system that doesn&039;t work,” Todd O’Boyle, director of the Media and Democracy Project at Common Cause, a progressive advocacy organization, told BuzzFeed News. “Consumers understand that they deserve better, that allowing well connected firms to write their own rules doesn’t advance the public interest,” he said. “I think that message is finally coming up from the grassroots to policy makers in Washington.”

In a sign that concerns over market concentration have gained prominence in the public sphere, the AT&T merger played a role in this week’s Sunday morning political chatter and prompted responses from both presidential candidates. Whereas Trump would like to see the deal scrapped, Hillary Clinton and Tim Kaine both said the merger deserves a close look.

“The fact that Donald Trump might agree on something doesn&039;t make it bipartisan”

In a major policy speech this summer, Sen. Elizabeth Warren pushed for a reinvigorated approach to antitrust enforcement. She called out some of the biggest names in tech — Apple, Amazon, and Google — for what she claimed were anticompetitive practices. And she pressed for greater scrutiny over so-called “vertical mergers,” the kind of deal that AT&T and Time Warner hope to pull off — one that combines a supplier with a distributor. In a Facebook post Tuesday, Warren urged regulators to take a “very, very close look” at the proposed merger.

“When it comes to antitrust, there has been a changing approach,” John Bergmayer, senior counsel at Public Knowledge, a digital rights advocacy group, told BuzzFeed News. “The ‘Elizabeth Warren attitude’ has become more prevalent among Democrats around DC. There’s a lot more willingness to challenge deals forthrightly,” he said.

AT&T, for its part, insists that its purchase of Time Warner is more likely to receive the government&039;s blessing because the two companies do not compete with one another. For instance, Comcast’s failed deal to acquire Time Warner Cable last year was an example of “horizontal consolidation,” in which two firms in the same industry tried to combine. “All of the deals that have gotten in trouble … over the last few years have been horizontal mergers, where a competitor is being taken out of the marketplace,” AT&T CEO Randall Stephenson said in a call with investors Monday.

In a statement to BuzzFeed News, AT&T’s general counsel David McAtee said, “We look forward to discussing the many benefits of this transaction with our regulators.” According to AT&T, the benefits to its 100 million customers would include new types of subscriptions designed for mobile screens and social media, as well as targeted advertising that would support the creation of new content and niche programming.

But regulators may conclude that AT&T’s takeover of Time Warner would harm competition. Critics of the deal argue that AT&T might privilege its own content over their competitors’; downgrade content offered by rival programmers; or extract higher fees from TV-providers who want to carry Time Warner content. (Netflix CEO Reed Hastings has suggested he would not oppose the merger so long as “HBO’s bits and Netflix’s bits are treated the same.”)

Part of the apprehension expressed by consumer advocates and policymakers over an AT&T-Time Warner union can be tied to a another colossal media merger, from 2011: Comcast’s acquisition of NBCUniversal, a deal that many believe should have never been approved. Federal regulators imposed conditions on that transaction to minimize the potential harm to consumers, including commitments by Comcast to provide affordable broadband to low-income families; increase local news programming; and to not discriminate against TV programs that compete with its own content. But experts contend that the spirit of those conditions has been violated and that they are generally difficult to enforce.

AT&T expects to make concessions during the merger review process. In a call with investors, the company’s leadership indicated that if regulators have lingering concerns, they can be addressed through conditions placed on the merger. But some say these conditional remedies aren’t good enough.

“There’s a dawning understanding that it’s very easy for well connected firms to make big promises, but it&039;s much more difficult for them to follow up and actually deliver on the proposed benefits,” said O’Boyle.

During her antitrust speech in July, Sen. Warren criticised the use of these conditional terms and recommended that regulators simply approve mergers or challenge them — with no strings attached.

“Many policymakers in Washington are still smarting from their approval of the Comcast-NBCUniversal merger,” said O’Boyle. “[They’re] realizing that it did not deliver a fraction of the benefits that were promised to consumers.”

But even with the Comcast baggage and the populist mood that has seized the electorate, the Justice Department’s antitrust division will vet the AT&T deal on its own terms.

“Not liking something isn’t a DOJ rationale for blocking the deal”

“Elizabeth Warren or Donald Trump or Bernie Sanders can yell, kick, and scream as much as they want,” BTIG analyst Rich Greenfield told BuzzFeed News. “They need to come up with a legal basis for the government suing AT&T. Not liking something isn’t a DOJ rationale for blocking the deal.”

Greenfield said that for all the rhetoric, he has yet to hear a sound legal argument that would justify blocking the proposed merger. “Even if the government regrets Comcast-NBCUniversal, even if the government thinks ‘big is bad,’ that in and of itself doesn’t mean you can block this.”

Berin Szoka, president of the free market think tank TechFreedom, told BuzzFeed News that rejecting the deal outright, as some politicians have done, is premature and thoughtless.

“The fact that Donald Trump might agree on something doesn&039;t make it bipartisan or demonstrate that there is real concern there,” he said. “It demonstrates that this is an easy rallying cry for demagogical populism on both sides of the political spectrum.”

Szoka added, “The whole point … of having a Department of Justice look at these things is to take them out of the hands of politicians.”

Perhaps the biggest question surrounding the deal is whether the Federal Communications Commission will join the review process. It’s not clear if the agency will, and the companies have not indicated if they will tailor the deal to avoid the FCC’s scrutiny. Unlike the Justice Department’s review, in which the companies have to demonstrate that a merger will not harm competition, the FCC has a broader mandate: for a merger to move forward, the firms must show that their marriage serves the public interest.

While it may appear that the FCC places a higher burden on companies in its approval process — since they have to affirmatively prove a benefit to consumers — Bergmayer said that the DOJ, as a law enforcement agency, has tremendous practical power in its ability to gather information, and it can do so largely beyond public view. Each agency presents their own challenges to potential mergers, he said.

In either case, advocates hope that regulators will take a hard look at the deal, encouraged by the growing sense among policymakers and the current administration, that industry concentration has increased as entrepreneurship has declined.

A source who has worked on previous media deals noted that while the Justice Department’s antitrust division is non-partisan, the head of the division, like the attorney general, is appointed by the president. What’s more, the DOJ’s career lawyers and economists have heard what the presidential candidates have said during the campaign, which might inform how they approach their daily work and broader mission, the source told BuzzFeed news.

The AT&T-Time Warner review is expected to last through the end of next year. Ultimately, a Clinton or Trump administration will decide whether it succeeds. For either of them, the deal will test their to commitments to thwart excessive consolidation and abuse of economic power. And in the more likely scenario that the merger lands on Clinton’s desk, the review may reveal how much influence Sens. Warren and Sanders have on her administration, and if the populist faction they represent holds sway.

Thumbnail credit: George C. Beresford/Hulton Archive/Getty Images

Quelle: <a href="Advocates Sense New Moment in Antitrust As Opposition Grows Against AT&T Merger“>BuzzFeed

Published by