An investment fund that includes billions from the government of Saudi Arabia has gone on a buying spree since launching a few months ago, taking huge stakes in a number of major tech companies.

The SoftBank Vision Fund announced in May that it had raised $93 billion, making it the largest ever fund for investing in privately held tech startups. Much of that capital came from Saudi Arabia's sovereign wealth fund, which said it would chip in $45 billion over a five-year period. Big chunks of capital also came from an Abu Dhabi government fund, and from the SoftBank Group, the Japanese conglomerate that created the Vision Fund. (Smaller contributions came from major tech companies such as Apple and Qualcomm.)

The Vision Fund has subsequently been writing enormous checks for startups, helping the Japanese SoftBank Group and Saudi Arabia expand their influence in the tech world. It also benefits from the fact that the SoftBank Group had been making big startup investments for a little while; some of those investments are now being moved to the Vision Fund.

Seemingly overnight, the Vision Fund has become one of the biggest players in startupland.

The Vision Fund's latest head-spinning deal was announced on Thursday: $4.4 billion for WeWork, the provider of co-working spaces. (Some fine print: The capital came from both the Vision Fund and SoftBank Group itself, and $1.4 billion of the investment was previously announced.)

$4.4 billion is a huge sum for a startup investment. Other tech investors were doing spit-takes.

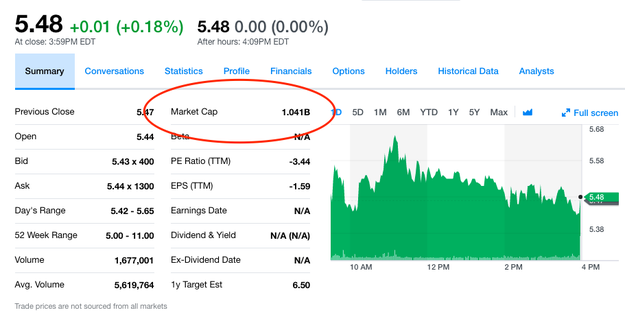

To make a flawed but possibly helpful comparison, $4.4 billion is roughly four times the size of the current market capitalization of Blue Apron.

Yahoo Finance / BuzzFeed News

(Blue Apron has had its struggles since going public, but still — four times as big as an entire company's market cap!)

The WeWork deal is only the latest example of the Vision Fund's eating the tech world. Here are some recent others:

The Vision Fund led a $114 million investment in Brain Corp, a startup developing technology to help robots navigate around obstacles.

giphy / Via media.giphy.com

It also led a $200 million investment in Plenty, an indoor farming company, calling the deal “the largest agriculture technology investment in history.”

giphy / Via media.giphy.com

And it agreed to invest a whopping $2.5 billion in the Indian e-commerce giant Flipkart, according to news reports. The deal turned the Vision Fund into Flipkart's biggest investor.

giphy / Via media.giphy.com

The Vision Fund has also been vacuuming up investments from the SoftBank Group's portfolio. For example:

It picked up a $5 billion stake in the publicly traded chip maker Nvidia.

giphy / Via media.giphy.com

And it acquired a roughly $8 billion stake in the British chip designer ARM, a company that SoftBank bought last year.

giphy / Via media.giphy.com

The Vision Fund has the right to acquire numerous other SoftBank investments, too.

These include SoftBank's big investments in the financial startup SoFi, which refinances student loans…

…and in the satellite internet company OneWeb.

giphy / Via media.giphy.com

The Vision Fund is just one way that SoftBank and Saudi Arabia have been investing in tech. On their own, both of those investors have been busy plowing capital into Silicon Valley.

SoftBank, for example, recently agreed to co-lead a $250 million investment in Slack, according to news reports.

And last year, Saudi Arabia put $3.5 billion in Uber, in one of the biggest ever startup investments.

Oh, and SoftBank reportedly has been in talks to make its own investment in Uber.

giphy / Via media.giphy.com

You can expect more headline-making deals from the Vision Fund in the future. It is aiming to raise a total of $100 billion in capital — which it intends to invest in private and public tech companies.

Quelle: <a href="This Fund Backed By Saudi Money Is Taking Over The Tech World“>BuzzFeed

Published by